Impact of New Taxes on Batteries for Electric Vehicles in Kenya.

The introduction of new taxes on batteries for electric vehicles (EVs) in Kenya is set to have significant implications for the country's burgeoning electric mobility sector.

The introduction of new taxes on batteries for electric vehicles (EVs) in Kenya is set to have significant implications for the country's burgeoning electric mobility sector.

These taxes, recently announced as part of the government's fiscal policies, aim to boost revenue but also raise concerns about their potential impact on the affordability and adoption of electric vehicles.

Rising Costs for Consumers and Manufacturers

The immediate effect of the new taxes on batteries is an increase in costs for both consumers and manufacturers.

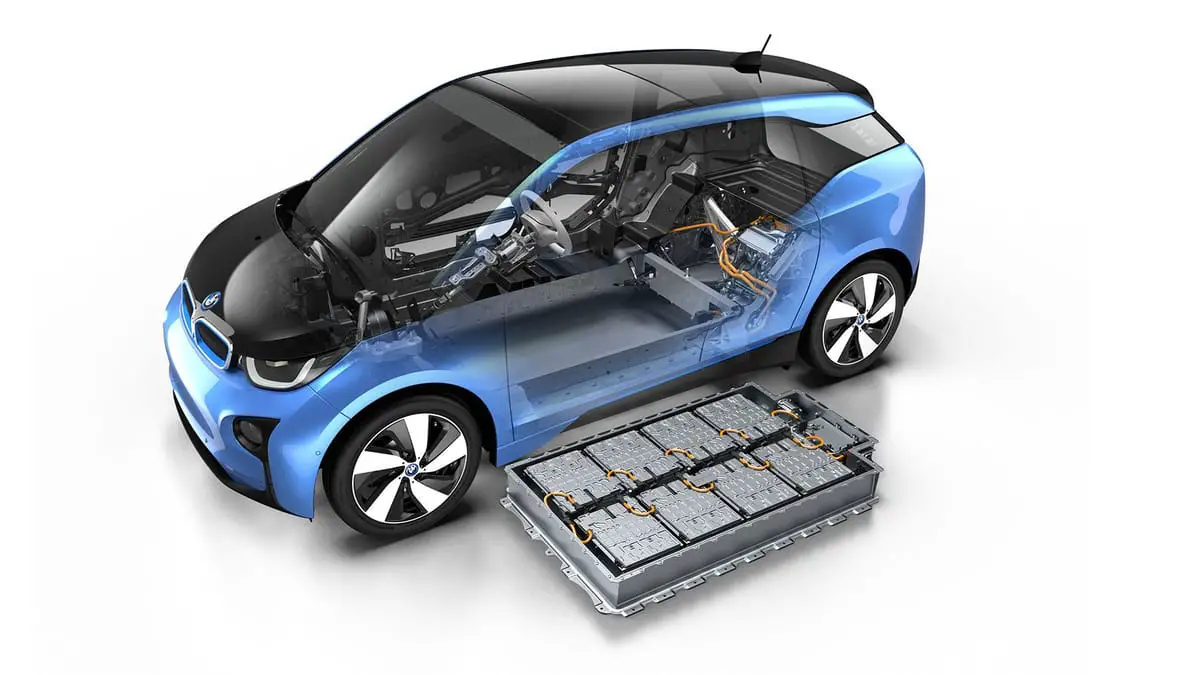

Batteries are a critical component of electric vehicles, and any additional tax will elevate the overall cost of EVs.

For consumers, this could translate to higher purchase prices, potentially slowing down the adoption rate of electric vehicles in Kenya, where price sensitivity is a significant factor for many buyers.

Manufacturers, on the other hand, will face higher production costs. This increase may lead to either higher prices for consumers or reduced profit margins for manufacturers if they choose to absorb the additional costs.

For local assembly firms and smaller companies in Kenya, the new taxes could pose substantial financial challenges, affecting their ability to compete in the market.

Implications for EV Market Growth

Kenya has been making strides in promoting electric mobility, with efforts to increase the number of registered electric vehicles and attract investment in the sector. However, the new taxes on batteries could hinder these efforts by making electric vehicles less financially attractive compared to traditional internal combustion engine vehicles. This could slow the growth of the EV market in Kenya and affect the country's goals for reducing carbon emissions and transitioning to greener transportation.

The increased costs may also deter international manufacturers and investors from entering or expanding their presence in the Kenyan market. This could limit the availability of electric vehicles and related technologies in the country, further slowing down market growth.

Impact on Local Manufacturing and Innovation

While the new taxes pose challenges, they might also spur innovation within the local manufacturing sector. Kenyan companies may accelerate their research and development efforts to create more cost-effective and efficient battery solutions. This could lead to advancements in battery technology and the development of alternative energy storage systems that are less affected by the new taxes.

Moreover, the tax policy could incentivize the growth of a domestic battery manufacturing industry, reducing reliance on imports and potentially lowering costs in the long run. The development of local manufacturing capabilities could also create jobs and stimulate economic growth.

Potential Shifts in Market Dynamics

The introduction of new taxes on batteries may lead to shifts in market dynamics. Manufacturers might look for ways to mitigate the impact of these taxes by sourcing alternative materials or improving battery recycling processes. Enhanced recycling can reduce the need for new raw materials, thereby lowering production costs and environmental impact.

Additionally, there could be a push for regional cooperation and trade agreements to source batteries from countries with lower or no taxes, thereby minimizing the cost increases. This could affect the supply chains and trade relationships within the East African region.

Government Strategies and Consumer Incentives

To counteract the negative effects of the new battery taxes, the Kenyan government might consider implementing various incentives and subsidies for electric vehicles.

These could include tax credits, rebates, and grants for both manufacturers and consumers to help maintain the affordability of EVs.

Investing in infrastructure, such as charging stations, and offering benefits like cheaper electricity tariffs, reduced parking rates, and access to restricted areas for EV owners could also encourage the adoption of electric vehicles.

Such measures would support the government's broader environmental and economic goals.

Conclusion

The introduction of new taxes on batteries for electric vehicles in Kenya presents a complex scenario with both challenges and opportunities.

While these taxes may increase costs and potentially slow the adoption of EVs, they also offer a chance to drive local innovation and manufacturing.

The Kenyan government and industry stakeholders will need to work collaboratively to navigate these changes and continue advancing towards a sustainable and electrified transportation future.

By balancing tax policies with supportive measures, Kenya can still achieve its green mobility goals while fostering economic growth and environmental sustainability.