How to cater to the rising demand for electric batteries.

The age of the electric car is upon us. Earlier this year, the US automobile giant General Motors announced that it aims to stop selling petrol-powered and diesel models by 2035

The age of the electric car is upon us. Earlier this year, the US automobile giant General Motors announced that it aims to stop selling petrol-powered and diesel models by 2035. Audi, based in Germany, plans to stop producing such vehicles by 2033. Many other automotive multinationals have issued similar road maps. Suddenly, major carmakers’ foot-dragging on electrifying their fleets is turning into a rush for the exit.

The electrification of personal mobility is picking up speed in a way that even its most ardent proponents might not have dreamt of just a few years ago. In many countries, government mandates will accelerate change. But even without new policies or regulations, half of the global passenger-vehicle sales in 2035 will be electric, according to the BloombergNEF (BNEF) consultancy in London.

We are looking forward to a world having fully electric vehicles, scientist are working to curb the material challenge which is the major challenge so far. The major challenge is how to cut down the metals in batteries that are scarce, expensive, or problematic because their mining carries harsh environmental and social costs. Another is to improve battery recycling so that the valuable metals in spent car batteries can be efficiently reused.

Battery and carmakers are already spending billions of dollars on reducing the costs of manufacturing and recycling electric-vehicle (EV) batteries, spurred in part by government incentives and the expectation of forthcoming regulations. National research funders have also founded centers to study better ways to make and recycle batteries. Because it is still less expensive, in most instances, to mine metals than to recycle them, a key goal is to develop processes to recover valuable metals cheaply enough to compete with freshly mined ones.

Lithium future

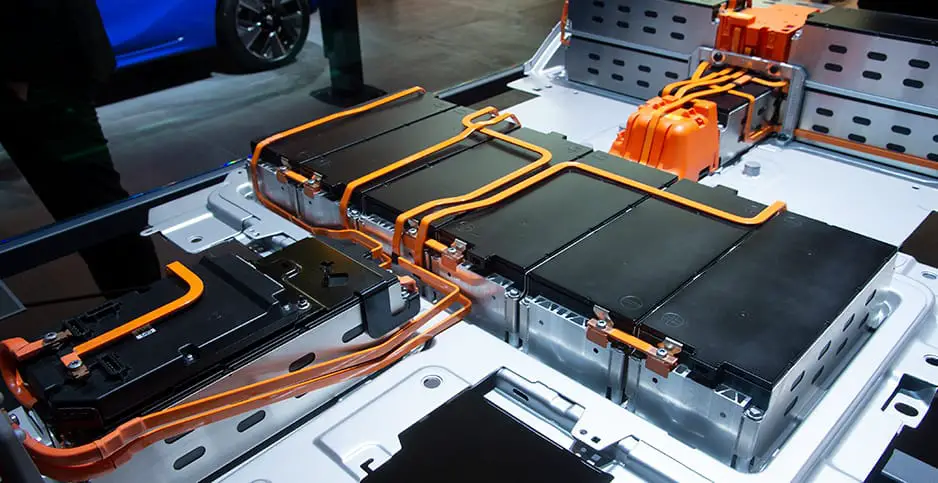

The first challenge for researchers is to reduce the amounts of metals that need to be mined for EV batteries. Amounts vary depending on the battery type and model of vehicle, but a single car lithium-ion battery pack (of a type known as NMC532) could contain around 8 kg of lithium, 35 kg of nickel, 20 kg of manganese, and 14 kg of cobalt, according to figures from Argonne National Laboratory.

Analysts don’t anticipate a move away from lithium-ion batteries any time soon: their cost has plummeted so dramatically that they are likely to be the dominant technology for the foreseeable future. They are now 30 times cheaper than when they first entered the market as small, portable batteries in the early 1990s, even as their performance has improved. BNEF projects that the cost of a lithium-ion EV battery pack will fall below US$100 per kilowatt-hour by 2023, or roughly 20% lower than today. As a result, electric cars, which are still more expensive than conventional ones, should reach price parity by the mid-2020s.

To produce electricity, lithium-ion batteries shuttle lithium ions internally from one layer, called the anode, to another, the cathode. The two are separated by yet another layer, the electrolyte. Cathodes are the main limiting factor in battery performance, and they are where the most valuable metals lie. The cathode of a typical lithium-ion battery cell is a thin layer of goo containing micro-scale crystals, which are often similar in structure to minerals that occur naturally in Earth’s crust or mantles, such as olivine's or spinel's. The crystals pair up negatively charged oxygen with positively charged lithium and various other metals, in most electric cars, a mix of nickel, manganese, and cobalt. Recharging a battery rips lithium ions out of these oxide crystals and pulls the ions to a graphite-based anode where they are stored, sandwiched between layers of carbon atoms.

Source: Davide C (2021) Electric cars and batteries: how will the world produce enough?